Why Invoice Factoring Works

How Does it Work?

Running a B2B (Business to Business) or B2G (Business to Government) business often means waiting 30, 60, or even 90 days for clients to pay. Even when customers pay on time, the delay can leave you short on cash for payroll, inventory, or growth opportunities.

That’s where invoice factoring comes in.

Invoice factoring allows you to sell your unpaid invoices to a factoring company in exchange for immediate cash. Instead of waiting weeks or months, you get up to 90% of your invoice value within 24 hours. Once your client pays, the remaining balance (minus a small fee) is sent to you.

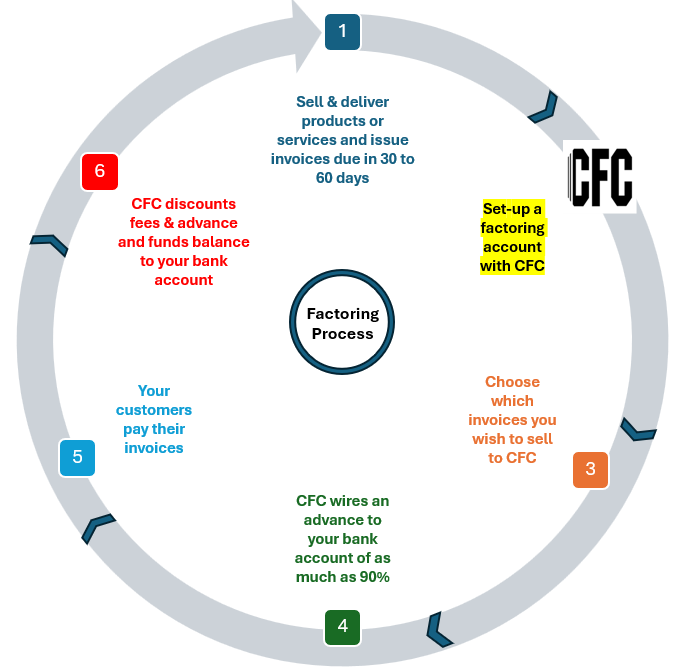

Factoring Process

1) You choose which customer(s) and which invoice(s) you wish to sell to Carter Funding. Seamlessly upload invoices through our secure online portal.

2) Carter Funding will advance 85-90% on those invoices via same-day wire or next-day ACH.

3) When funds have been collected from your customer, Carter Funding will remit the remaining 10-15% directly to your bank account and withold a factoring fee of as little as 1.0%.

Why Carter Funding?

Invoice factoring is a flexible financing solution that allows businesses to access immediate funds by selling their unpaid invoices for immediate access to cash. By using invoice factoring, businesses can improve cash flow, stabilize operations, and support growth by receiving working capital without waiting for customers to pay their invoices.

Carter Funding is family-owned and operated since 1994. When you work with us, you have direct access to decision makers and principals. No 1-800 phone numbers, no funding delays, no waiting for responses from your account representatives.

Quick Access to Cash

Once onboarded with CFC, fundings occur same-day, often times within minutes.

Competitive Rates

Carter Funding advances up to 90% against your outstanding invoices and charges as little as 1% in factoring fees.

Flexibility

Unlike traditinal financing sources, factoring allows for the utmost financial flexibility. Whether your business is navigating through distress, adding clients or looking to capitalize on new opportunities, CFC provides a seamless solution to your capital needs.

Cash Flow

CFC is here when you need us, and only when you need us. Factoring allows for smooth cash flow. We don;t require long-term contracts and you choose which invoices you wish to factor. Unlike some of our competitors, you’re in control of your cash flow.

Call 901-685-1571 Today!

See what Carter Funding Corporation can do for you and your business.

Questions about invoice factoring?

We would love to hear from you and answer any questions you might have about Carter Funding Corporation or the factoring process in general.