Invoice Factoring

Invoice Factoring – Fast, Flexible Working Capital

When customers take 30, 60, or even 90 days to pay, your cash is tied up in invoices. This makes it hard to cover payroll, pay taxes, or take on new opportunities. For many small businesses and startups, bank loans aren’t an option due to strict approval requirements.

Invoice factoring is the smarter solution. Instead of waiting for customers to pay, you sell your invoices to us and get cash in hand—fast.

Who Can Qualify?

Getting approved for invoice factoring is much easier than applying for a loan. Requirements are simple:

-

B2B or B2G business with reliable clients

-

Invoices due within 90 days

-

No serious tax or legal issues

How It Works

- You submit an invoice—for example, $50,000.

- We verify it and advance up to 90% within 24 hours ($45,000).

- Your customer pays the invoice in full.

- We release the balance, minus a small fee.

- You get steady cash flow without taking on debt.

Why Businesses Choose Invoice Factoring

-

Quick cash—funded in as little as 24 hours

-

No new debt or liabilities

-

Easier approval than traditional financing

-

No credit limits, contracts, or minimums

-

Funds available for payroll, taxes, supplies, or growth

-

Flexibility—your funding grows as your invoices grow

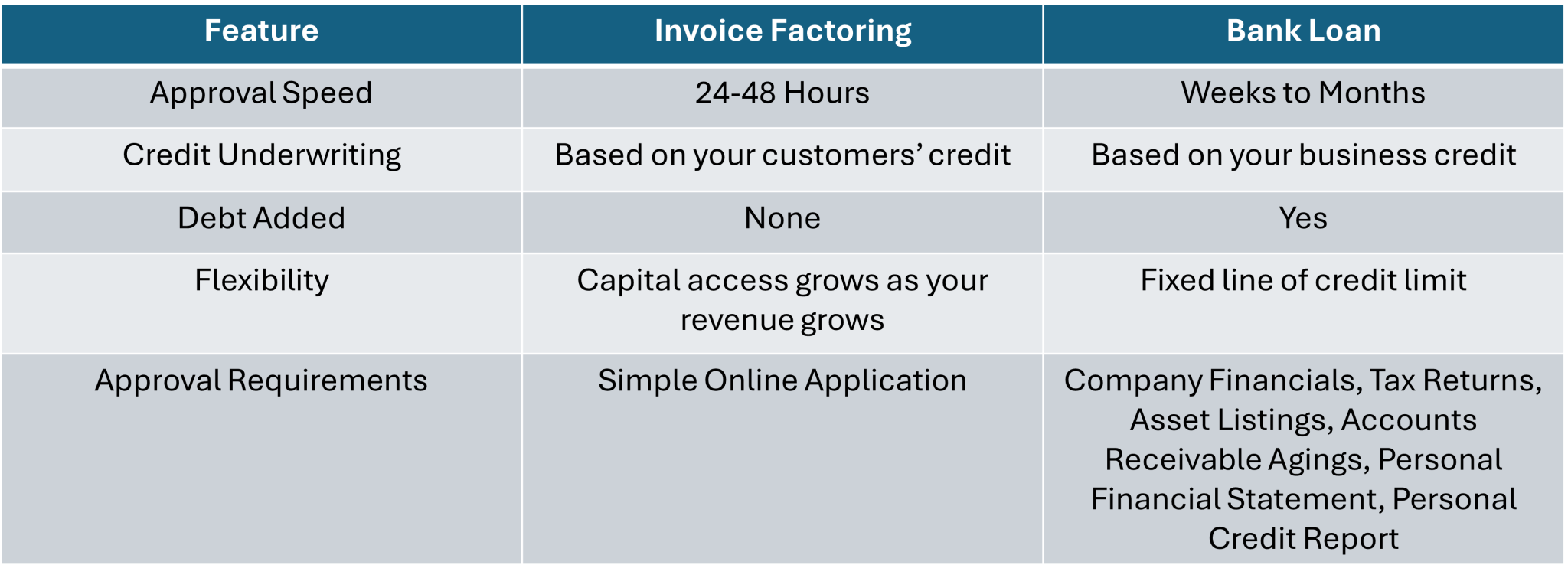

Factoring Vs. Bank Debt

Call 901-685-1571 Today!

See what Carter Funding Corporation can do for you and your business!

Questions about invoice factoring definition? Call us now! We would love to hear from you and answer any questions you might have regarding invoice factoring. You can also learn more about business factoring, factoring companies for trucking, freight factoring companies, invoice factoring calculator and more.

Contact Us Today!

Carter Funding Corporation

4938 William Arnold Rd

Memphis, TN 38117

See Map

Phone: 901-425-1083

Fax: 901-685-1579

Read More About Invoice Factoring

Factoring For Security Staffing Services

Security staffing companies often have problems when it comes to closing the cash flow gap. This is mostly because such enterprises provide services on credit terms that are flexible. Even though this helps in building long-term working relationships with their...

How Invoice Factoring Works for Staffing Agencies

Staffing agencies, also known as temp agencies, may often suffer from cash flow problems. These issues arise from their steep expenses: paying their employees, paying dues such as rent, or purchasing supplies. They are not paid by their clients until they fill the...

Funding for Temporary Staffing Agencies

Temporary staffing agencies are always battling the gap. What gap, you ask? It’s a virtual gap that exists between the need to pay their employees on time, and the payments from their clients. Factoring companies fill this gap by offering them funding. They provide...

Our Most Common Invoice Funding Questions – Answered!

Invoice factoring may seem like a difficult task, but it is not that difficult! Here are a few of the most common FAQ's that we get at Carter Funding! How Can Factoring Benefit My Company? Carter Funding Corporation can help make you more profitable by providing...

Questions about invoice factoring?

Call us now! We would love to hear from you and answer any questions you might have about accounts receivable line of credit, factoring receivables interest expense, invoice factoring quotes and or general invoice factoring questions.

We offer industry-Service specific factoring options such as small business funding opportunities, security industry invoice factoring, accounts receivable factoring technology Industry, small business funding opportunities, government contract invoice factoring, invoice factoring service industry, accounts receivable factoring manufacturing industry, accounts receivable staffing industry, invoice factoring for Amazon vendors, factoring for cash flow and many others. Just give Carter Funding a call to learn more!